Irs 720 Form

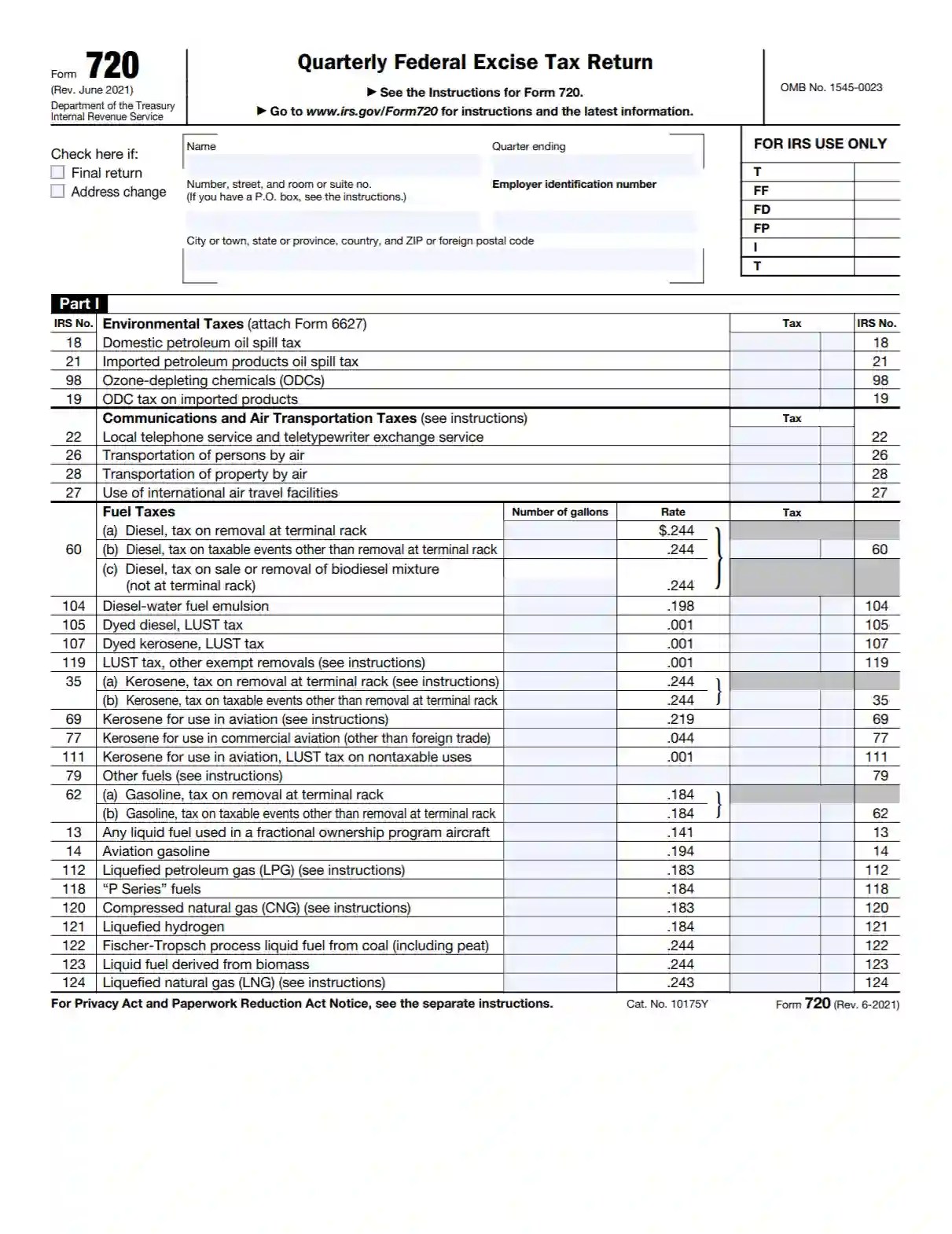

Irs 720 Form - Web irs form 720 is used to calculate and pay excise taxes on certain products and services, such as alcohol, tobacco, fuel, and airline tickets. Web learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. It includes three parts, plus schedule a. The form has two parts: Web irs form 720, officially titled the quarterly federal excise tax return, is a pivotal tax form for reporting and remitting federal excise taxes. Web purpose of form 720:

The quarterly federal excise tax return is used to file and pay excise taxes due on a quarterly basis to keep liabilities under control. Web download or print the 2023 federal form 720 (quarterly federal excise tax return) for free from the federal internal revenue service. Find out the latest rates, rules, and developments for 2021, including. Find out the benefits, costs, and. If your expat business deals in those particular products, the irs requires that you file.

Web what is form 720? Find out the latest rates, rules, and developments for 2021, including. We will use the completed. Web irs form 720 is used to report and pay various federal excise taxes, such as fuel, communications, air transportation, and insurance taxes. Web irs form 720, officially titled the quarterly federal excise tax return, is a pivotal tax form for reporting and remitting federal excise taxes. Web download or print the 2023 federal form 720 (quarterly federal excise tax return) for free from the federal internal revenue service.

Find out the latest rates, rules, and developments for 2021, including. It includes three parts, plus schedule a. You aren't required to file form 720 reporting excise taxes for the calendar quarter, except.

Web Irs Form 720, Officially Titled The Quarterly Federal Excise Tax Return, Is A Pivotal Tax Form For Reporting And Remitting Federal Excise Taxes.

Web irs form 720 is a quarterly tax return for businesses that sell products or services subject to excise tax, such as gasoline, airline tickets, or indoor tanning. Web learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. The quarterly federal excise tax return is used to file and pay excise taxes due on a quarterly basis to keep liabilities under control. Find out the latest rates, rules, and developments for 2021, including.

It Includes Three Parts, Plus Schedule A.

We will use the completed. If your expat business deals in those particular products, the irs requires that you file. The form is the information reporting return for taxpayers that must pay federal excise taxes. Web purpose of form 720:

Find Out The Benefits, Costs, And.

Web download or print the 2023 federal form 720 (quarterly federal excise tax return) for free from the federal internal revenue service. Web you don't import gas guzzling automobiles in the course of your trade or business. Web what is form 720? The form has two parts:

Learn Who Needs To File, How To Fill Out.

Web learn how to file form 720 to report and pay federal excise taxes on fuels, transportation, and health care. Web irs form 720 is used to calculate and pay excise taxes on certain products and services, such as alcohol, tobacco, fuel, and airline tickets. Web under us federal regulations, certain products are subject to an excise tax. You aren't required to file form 720 reporting excise taxes for the calendar quarter, except.